≡

≡

The Value Of A New Customer

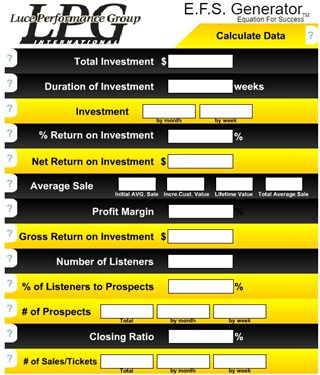

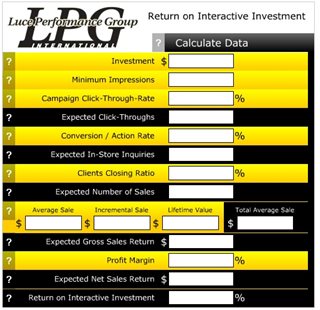

Jan 4, 2019 by Mark Maier At Luce Performance Group, our ROII (Return On Interactive Investment) and EFS (Equation For Success ROI Generator) tools have included Lifetime Customer Value from thier inception as it creates the total average sale value. MediaPost reports on what that value means and how it translates into additional sales opportunities when considering Cost Per Acquisition...

At Luce Performance Group, our ROII (Return On Interactive Investment) and EFS (Equation For Success ROI Generator) tools have included Lifetime Customer Value from thier inception as it creates the total average sale value. MediaPost reports on what that value means and how it translates into additional sales opportunities when considering Cost Per Acquisition...

"DSW Inc. has been having a pretty good year, with second-quarter earnings growth of 65 percent year-over-year and a flaming-hot stock performance. The reason, according to the footwear retailer’s CEO, is a perfect combination of marketing and merchandising strategy that has activated its customers and increased its customer lifetime value.

Let those last two words sink in: lifetime value.

Working with direct-response clients, I’ve noticed a clear pattern among the most successful ones: They intimately understand the lifetime value of a new customer and build their customer acquisition formulas around long-term success, not day-one revenue. That means they’re thrilled to acquire a lead or customer at a small short-term loss in exchange for a big long-term gain.

Focusing on long-term profits in this way typically results in a huge, almost unfair competitive advantage for these savvy marketers, enabling them to outspend the competition thanks to the larger allowable cost per acquisition (CPA) they can afford.

Why Lifetime Value Should Guide Your Marketing Decisions

In my experience, the marketers who take the long view typically scale much faster and fly much higher. To determine whether this approach is right for your business, simply follow this “not-so-secret” four-step formula:

1. Determine the lifetime value of your typical customer. If you don’t currently measure LTV, do it immediately. LTV is essentially a forecast of a customer’s total worth over the lifetime of your relationship. Calculating it involves multiplying the average revenue you’ll collect from a customer (including initial sale, continuity, upsells, etc.) over the average customer life span. Understanding LTV is critical to determining the best business model for your long-term success.

2. Calculate the impact on growth of raising and lowering your CPA. You’ll typically find that you can acquire a small number of customers at an initial profit, a larger number of customers at a breakeven, or a massive number of customers at a slight initial loss.

If your lifetime value is high enough, you can see the clear case for taking a short-term loss in exchange for more scale and greater long-term profits. It may seem scary to “lose” money initially, but successful marketers view it more as an investment in the future.

Note: To execute this model, you’ll obviously need more cash flow and a way to fund this growth (via loans, lines of credit, investors, savings, etc.).

3. Test your assumptions. Even if everything makes sense on paper, it’s critically important to test your assumptions in the real world and iron out the kinks before you go big (or it could cost you big).

For example, one client had a good grasp of how long it took to monetize email leads on the back end and assumed the same metrics applied to converting co-registration leads. But the quality of co-reg leads paled in comparison to email leads, taking months longer to show returns and disrupting the company’s cash flow. Avoid this kind of surprise by testing and monitoring all assumptions.

4. Execute! If, after reverse-engineering your numbers and testing your assumptions, you conclude that the long-term approach will indeed grow business faster, step up to the big leagues and go for it. Just continue to meticulously monitor the numbers to ensure your assumptions remain valid.

Happy scaling!"

If you have questions on how our sales system places these two tools in front of clients to show ROI and drive the sales process, contact sean@luceperformancegroup.com

Related Categories